mchenry county illinois property tax due dates 2021

Tax Bill Is Not Ready. Mobile Home Due Date.

Credit card payments carry a 235 convenience fee.

. Taxing districts confirm final tax rates and extensions which the County Clerks Office then certifies to the Treasurers Office for billing. Once taxes for the selected year have been extended the tax bill will be available. These payments are still due on april 15 and can be based on either 100 of estimated or 90 of actual.

McHenry County has one of the highest median property taxes in the United. Ad Find McHenry County Online Property Taxes Info From 2021. Sign up for property tax reminders by email or text.

Property Tax Relief 2021 Distributed as a public service for property owners by. Illinois has one of the highest average property tax rates in the. Real Estate 2nd Installment Due Date September 6 2022 Interest Penalty imposed on payments madepostmarked after September 6.

Richmond Road Johnsburg IL 60051 8153850175 8153225150 Fax Website. 209 of home value. 173 of home value.

2021 Real Estate Tax Calendar payable in 2022 May 2nd. When searching choose only one of the listed criteria. Electronic check payments E-Checks have a flat fee depending on the payment amount.

Located at the southeast corner of Rt. The citys implementation of property taxation cannot infringe on Illinois constitutional guidelines. But how much was going to each tax district was not included.

The median property tax in McHenry County Illinois is 5226 per year for a home worth the median value of 249700. All other debit cards have a 235 convenience fee. Fees apply Pay by phone.

If you have documents to send you can fax them to the. Property tax bills mailed. Tax amount varies by county.

Do not enter information in all the fields. Now McHenry County Treasurer Glenda Miller has posted the easy way to figure how much property owners will have to dig up next month. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Drop box service available. You can call the McHenry County Tax Assessors Office for assistance at 815-334-4290. Payments can be made by phone at 1-877-690-3729.

These units work within outlined geographic area eg. Pay in person at. Real estate tax bills mailed earlier june and first due date of july 23 2021 and second due date of september 23 2021.

All real estate not exempted is required to be taxed. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. Tax bills are scheduled to be mailed out May 7 with installment due dates set for June 7 and Sept.

Using a credit card or direct withdrawal on our website. McHenry Township Assessor Mary Mahady CIAO 3703 N. Real Estate 1st Installment Due Date June 6 2022 Interest Penalty imposed on payments madepostmarked after June 6.

September 15 2021. McHenry County Property Tax Inquiry. Visa Debit card 395 flat fee.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. The requested tax bill for tax year 2021 has not been prepared yet. Contact your county treasurer for payment due dates.

McHenry County Treasurer Office. Tax amount varies by county. Last weekend McHenry County Blog passed on a way one could see how much one owes in real estate taxes this year.

May 7 2021. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Yearly median tax in McHenry County.

Last day to submit changes for ACH withdrawals for. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. You will need to use Jurisdiction Code 2301.

Illinois has one of the highest average property tax rates in the. In most counties property taxes are paid in two installments usually June 1 and September 1. 47 and Russell Ct with drive-thru service and 24-hr.

An agricultural preserve or hospital district. 173 of home value. Tax bills are mailed.

To search for tax information you may search by the 10 digit parcel number last name of property owner or site address. 09 - 10 - McHenry. Delinquent taxes sold at tax sale.

Receive McHenry County Property Records by Just Entering an Address. McHenry County collects on average 209 of a propertys assessed fair market value as property tax. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

5811 Landcaster Cir Mchenry Il 60050 Mls 11267676 Redfin

4305 Parkway Ave Mchenry Il 60050 Mls 11121433 Redfin

4913 Wildwood Dr Mchenry Il 60051 Mls 11078761 Redfin

824 Plymouth Ln Mchenry Il 60051 Realtor Com

3205 Foxview Highland Dr Mchenry Il 60050 Realtor Com

1114 N Cumberland Cir Mchenry Il 60050 Realtor Com

Mchenry County Illinois Courthouse Familysearch

1965 Concord Dr Mchenry Il 60050 Redfin

117 S Draper Rd Mchenry Il 60050 Mls 10948023 Redfin

407 Legend Ln Mchenry Il 60050 Realtor Com

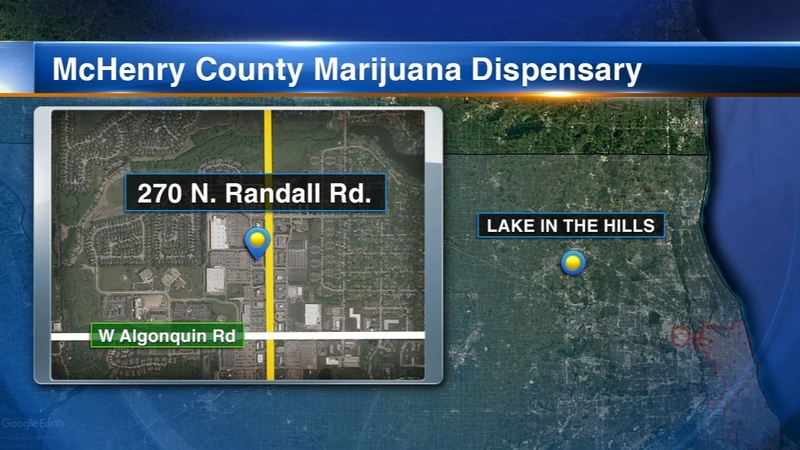

Illinois Weed Mchenry County Welcomes 1st Marijuana Dispensary In Lake In The Hills On Randall Road Abc7 Chicago

Internet Freedom For Mchenry County Faqs

4305 Parkway Ave Mchenry Il 60050 Mls 11121433 Redfin

4233 Savoy Ln 1 Mchenry Il 60050 Mls 11284597 Redfin

1621 Pleasant Ave Mchenry Il 60050 Mls 11132337 Redfin

2302 W Fairview Ln Mchenry Il 60051 Realtor Com